Here are the most important news items that investors need to start their trading day:

1. A magnificent boost

The stock market is welcoming a jolt from Nvidia on Thursday morning. The S&P 500 and Nasdaq are primed to pop after the company reported another strong quarter, sending its shares more than 10% higher in premarket trading. Heading into Thursday, the tech-heavy Nasdaq was on a three-day losing streak. Other potential catalysts for stocks on the day include weekly jobless claims and January existing home sales data, along with earnings from companies such as Moderna. Follow live market updates here.

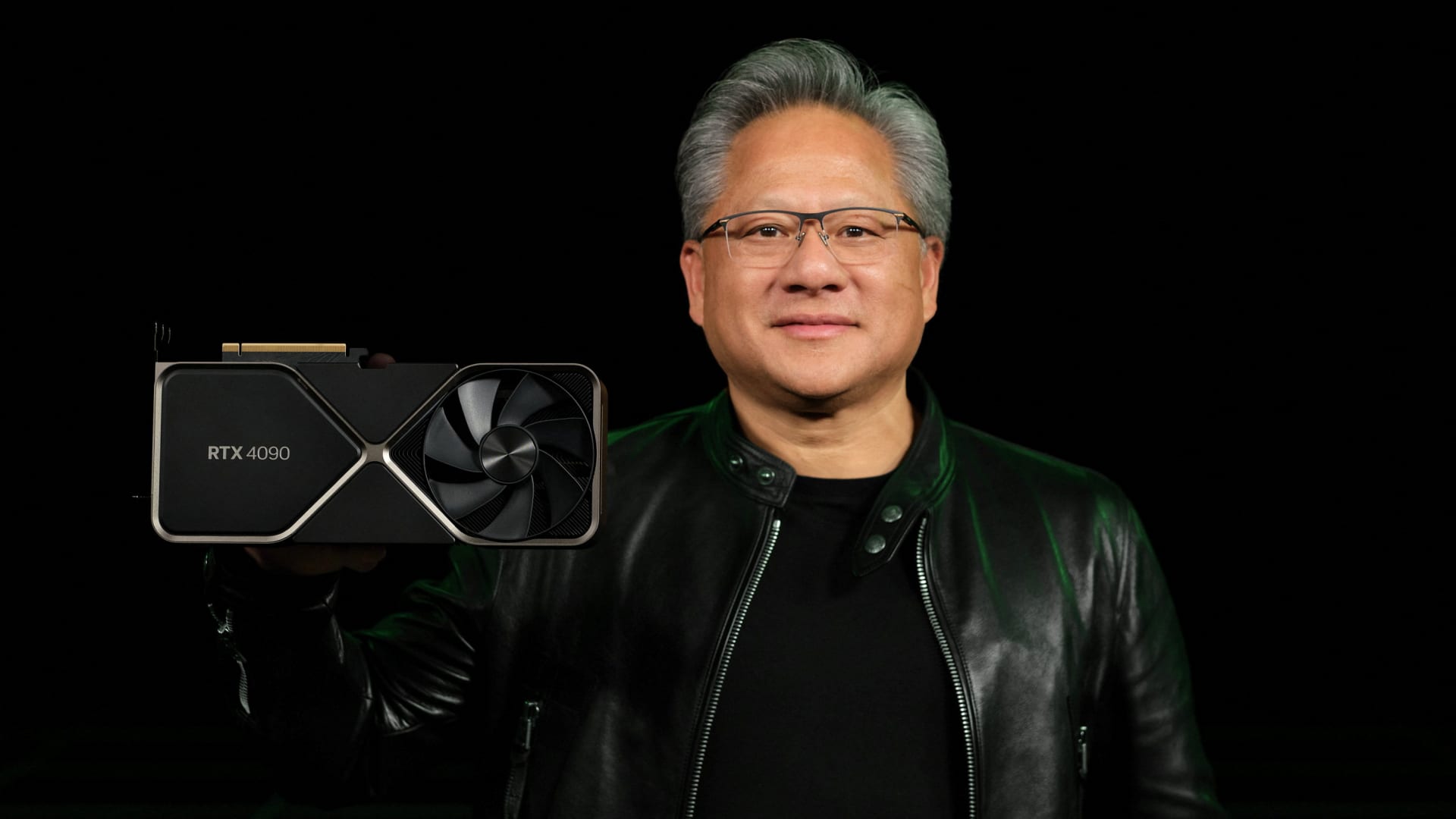

2. Feeling chipper

Nvidia beat Wall Street estimates for its fourth quarter, posting a 265% increase in revenue year over year on Wednesday. Strong demand for AI chips for servers, especially the company’s “Hopper” chips, fueled the revenue surge. CEO Jensen Huang also told analysts “the conditions are excellent for continued growth” next year and beyond. Nvidia’s stock price has soared nearly 200% in the last year as it has become the primary beneficiary in the industry’s AI boom.

3. Slow your roll

Federal Reserve policymakers suggested at their last meeting in January that they don’t want to move too fast to cut interest rates, according to minutes from the session released Wednesday. Overall, though, the minutes indicated the central bank officials felt optimistic about the success of the Fed’s efforts to rein in inflation after it hit its highest levels in more than 40 years in 2022. Policymakers suggested they are likely done hiking rates and that they want to see more progress in curbing price increases before they loosen monetary policy. Expectations for rate cuts have helped to boost the stock market this year.

4. Maxed out

5. Corporate jet crackdown

The IRS is getting more skeptical about corporate jets. The agency on Wednesday said it would conduct three to four dozen audits of corporate jet usage, mostly by corporations and complex partnerships, as part of an increase in scrutiny of high earners. The IRS is looking into whether companies are juicing tax deductions while using the craft for both business and personal travel. IRS Commissioner Danny Werfel said the audits “will help ensure high-income groups aren’t flying under the radar with their tax responsibility.”

– CNBC’s Yun Li, Kif Leswing, Jeff Cox, Leslie Josephs, Sara Salinas and Kate Dore contributed to this report.

— Follow broader market action like a pro on CNBC Pro.

Read the original article here