TAMPA, Fla. — Lynk Global has agreed to a merger that would raise money for the direct-to-smartphone operator and list its shares on Nasdaq, the venture said Feb. 5 in a regulatory filing that details its revenue projections for the emerging market.

The deal with Slam Corp., a publicly traded shell company led by former professional baseball player Alex Rodriguez that has been hunting for an investment opportunity for three years, values Lynk at $800 million.

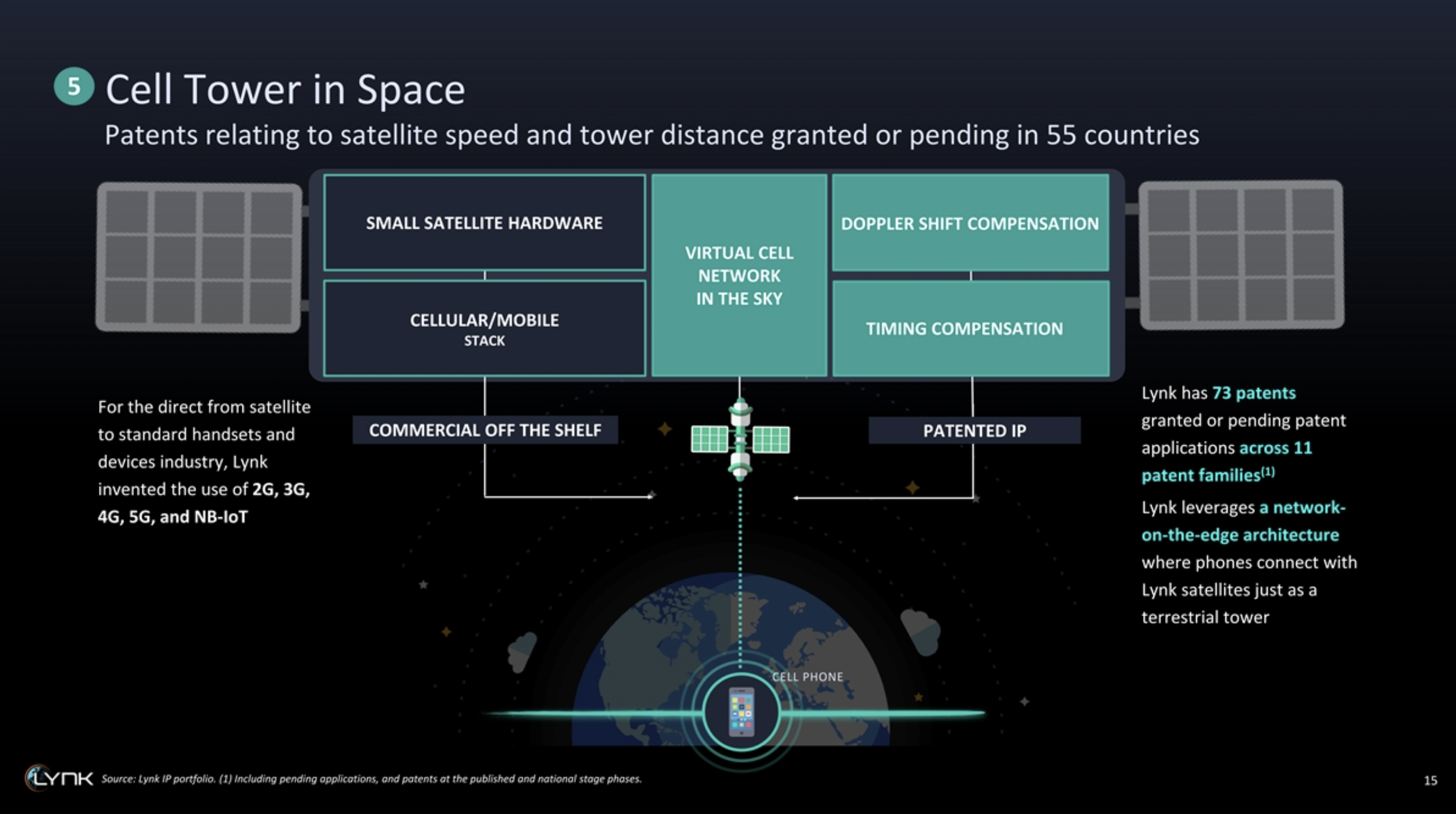

With three satellites in orbit providing intermittent connectivity to a handful of remote locations, Lynk sought the merger to fund a low Earth orbit constellation seeking to extend the reach of terrestrial mobile network operators beyond their cell towers.

However, it is unclear how much capital Lynk could raise by merging with Slam. The special purpose acquisition company (SPAC) has less than $99 million in trust following investor redemptions since raising $575 million from its 2021 stock debut.

Slam’s investors will be allowed to recoup their investments from the trust before the merger closes, instead of taking a stake in the combined company.

The merger agreement is also tied to a net cash investment of at least $110 million. If this is not reached, New York-based investment firm Antara Capital has agreed to invest $25 million to help offset investor redemptions.

Lynk also seeks to raise around $40 million in a Series B funding round.

“Lynk is pursuing a number of avenues to raise capital,†Lynk vice president of government affairs Tony DeTora said via email.

“We anticipate that some of those avenues will provide capital to Lynk prior to the closing of the merger with Slam. We will use those funds to produce more satellites, secure launches, and support satellite design and operations.â€

The companies anticipate closing the transaction in the second half of 2024.

Direct-to-smartphone business projections

Since testing its cellphone-capable payload in orbit in 2019 on a Cygnus space station dug departing the ISS, Lynk has deployed three operational satellites, the latest of which launched early last year.Â

With those three pizza-box-sized satellites, Lynk is currently enabling intermittent texting and other low-bandwidth services to unmodified phones in more than seven countries, according to an investor presentation accompanying the regulatory filing.

In partnership with local mobile operators, only three of these countries have been announced so far: Solomon Islands, Cook Islands, and Palau.

However, the investor presentation recorded no revenue to date. The first time the company details any revenues is during the first three months of 2025, when it expects to make around $100,000 with 38 satellites in orbit.

Lynk expects to generate $10 million in revenue over the following three months with 38 satellites.

The Falls Church, Virginia-based company’s projection extends to the fourth quarter of 2025, when Lynk expects to have made $41 million with 74 satellites — enough for what it says would be a seamless messaging service. By then, Lynk expects to be enabling satellite-based texting services for more than 100 million mobile network operator subscribers.

Lynk said it spends around $300,000 for the parts needed to build each satellite in-house. Each satellite can be assembled in about a month for a launch that costs around $650,000, according to the presentation.Â

The next two satellites for the constellation have already been funded for a launch in March on a SpaceX Falcon 9 rideshare mission.

Lynk’s merger plan comes weeks after Texas-based AST SpaceMobile announced a $155 million strategic investment from companies including AT&T to expand its direct-to-smartphone network. AST SpaceMobile trades shares on Nasdaq after merging with a SPAC in 2021.

SpaceX also recently launched its first batch of satellites to test a direct-to-smartphone capability in partnership with T-Mobile US.

Related

Read the original article here